Interarch Building Solutions

29 August

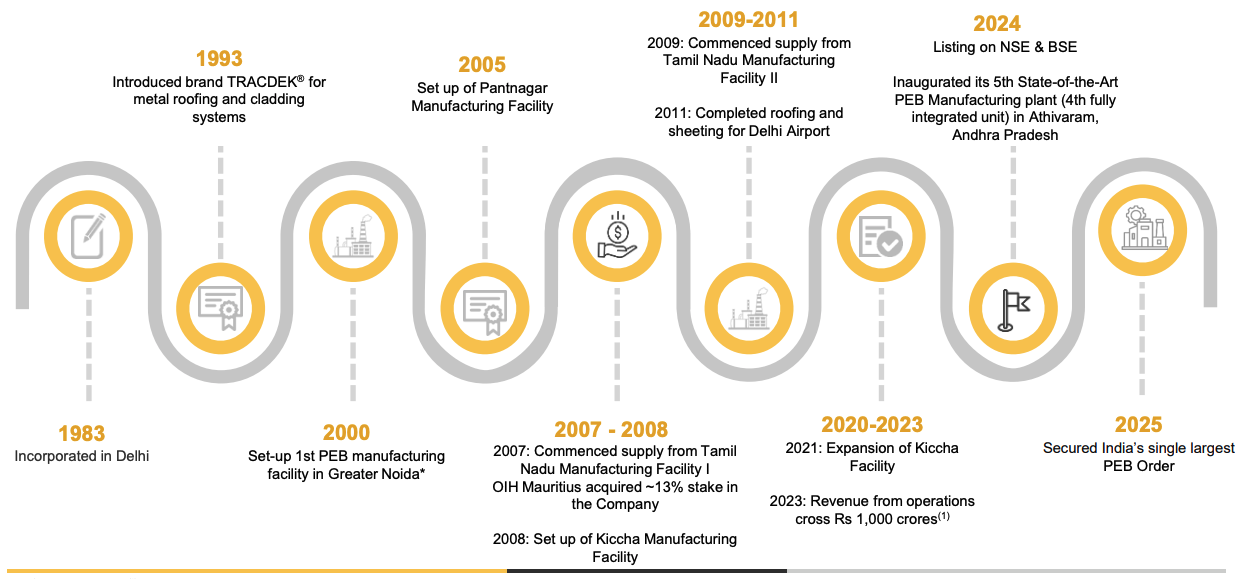

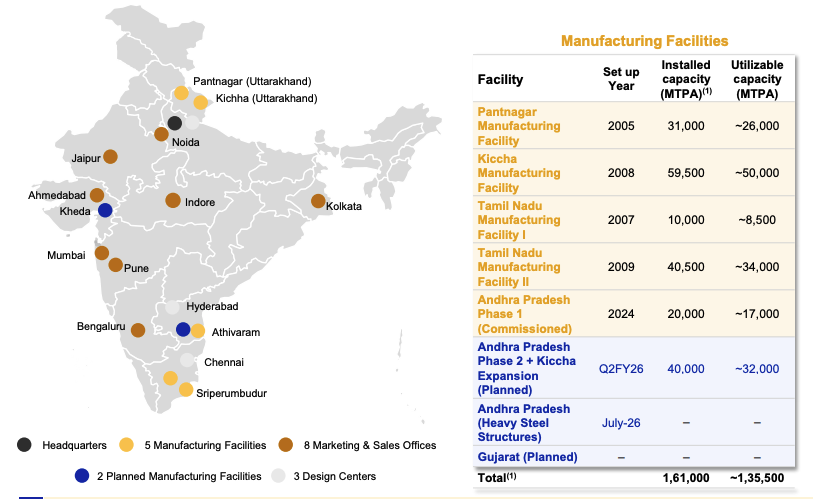

Incorporated in 1983, Interarch Building Solutions is a leading provider of turnkey pre engineered building (PEB). The company has integrated facilities for design, engineering, and manufacturing for the installation and erection of pre-engineered steel buildings, serving industrial/manufacturing, infrastructure and building constructions. It is the second-largest player in the sector by capacity, with a total annual production of 161,000 MTPA across five manufacturing facilities - two in Uttarakhand, two in Tamil Nadu, and one in Andhra Pradesh. Interarch serves marquee clients across automobiles, cement, paints, warehouses, and data centres, and has executed over 750 projects to date with over 40 years of experience.

Source: Company

Over the past three years, the company has consistently achieved a repeat order ratio exceeding 80%, where it is serving clients such as Aditya Birla Group, HUL, and the Tata Group. Recently, Interarch achieved a significant milestone by securing India's largest PEB contract, valued at 300+ crore, where it is serving as the sole contractor for the first time in the company's history.

Interarch has an order book of ₹1695cr as of 31st July 2025 which is to be executed within 8-10 months. Additionally, it has a project pipeline (referred to as P1) worth ₹2500 crore, with management anticipating a conversion rate of 25%. Beyond this, there are enquiries totalling around ₹4000 crore (classified as P2), which are at the stage of initial estimates and preliminary discussions.

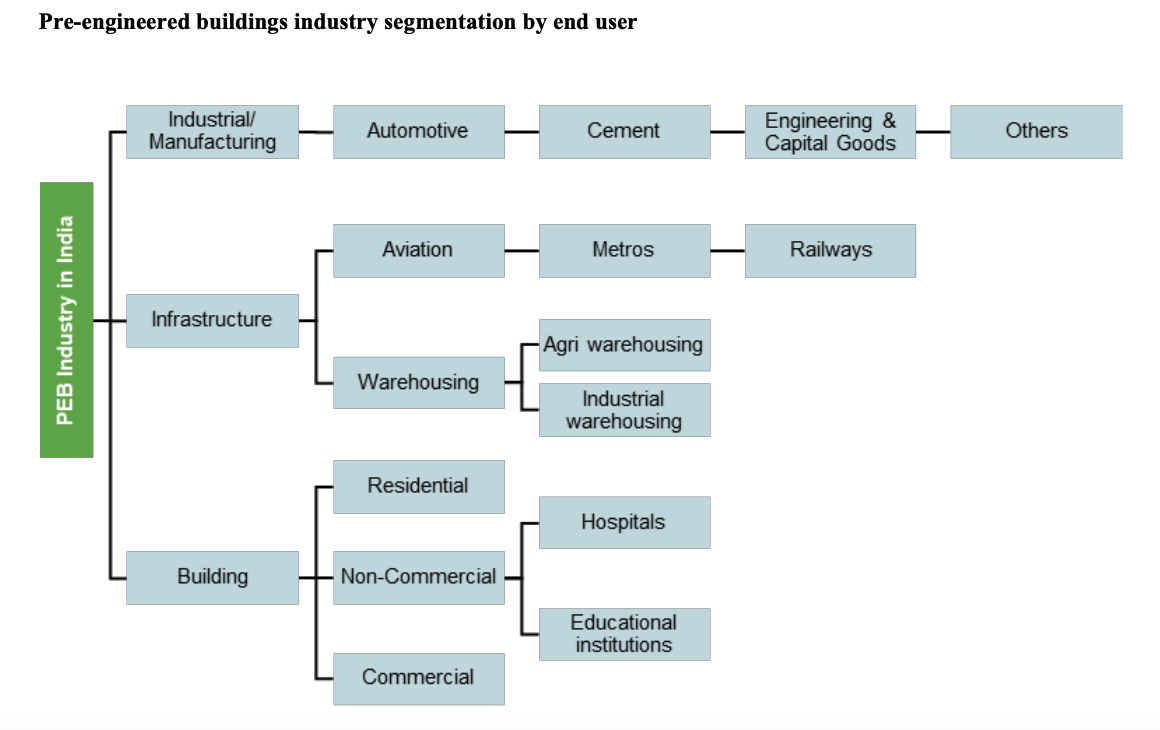

Pre Engineered Buildings Industry

What are pre engineered buildings?

Pre-engineered steel buildings (PEB) are structures constructed from fabricated steel components. These buildings are designed and manufactured off-site and then assembled on-site. This method reduces construction time, minimizes waste, and ensures consistent quality, making it an attractive option for industries such as manufacturing, logistics, retail, aviation, and warehousing. Everything from design, engineering, production, making the items, delivering it to site and erecting it at site is executed under a single lump-sum contract.

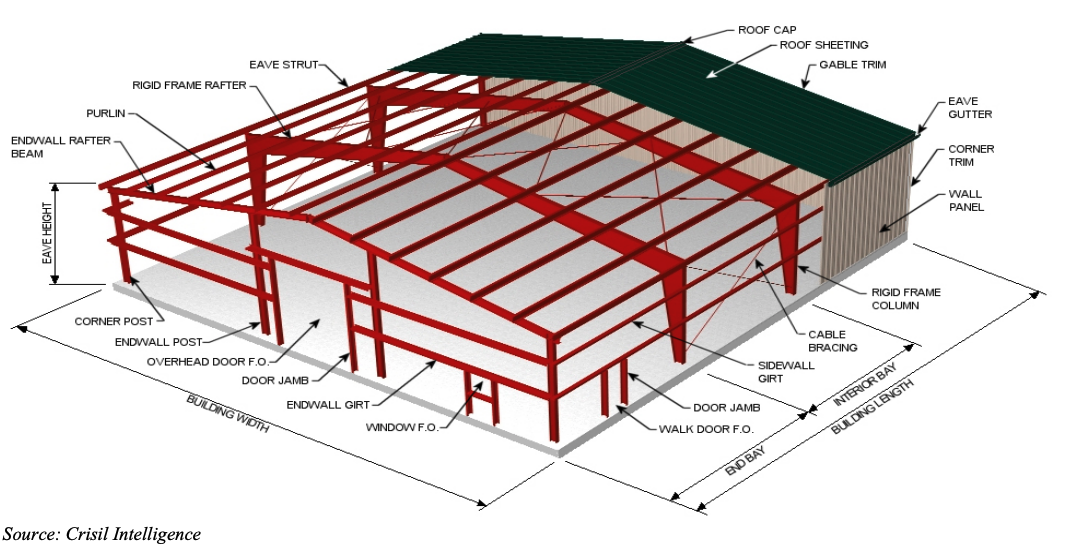

Key components of pre-engineered buildings

Main frame or primary structure: The main load-bearing system of a PEB, made of rigid steel frames. It includes columns, rafters, and other supporting members, with shape and size varying by application. Frames are typically assembled by bolting the end plates of connecting sections together.

Secondary structure: This includes purlins, girts, and eave struts that provide support to roof and wall panels. Purlins support the roof, girts support the walls, and eave struts are placed at the intersection of the sidewall and roof.

Roof, wall panels, and insulation: These components form the external envelope of the building and are usually made of ribbed steel sheets produced from coils. They are used for roofing, wall cladding, liners, partitions, and sheeting, and can be combined with insulation materials for thermal efficiency..

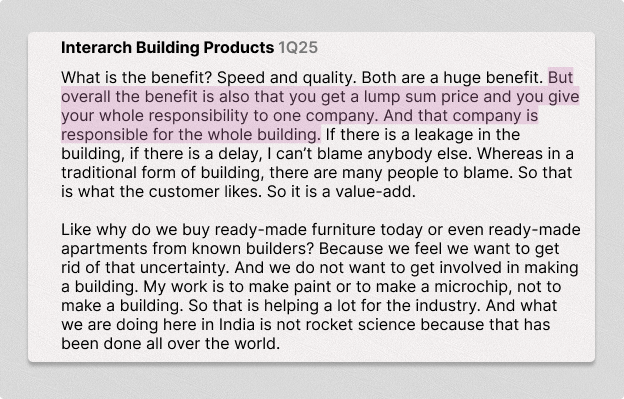

Key benefits of PEB

- Faster construction: As pre-engineered construction involves components being manufactured at the factory beforehand, it allows for the simultaneous preparation of the foundation at the construction site. This helps accelerate project timelines and decreases overhead site costs, including labour costs. Factory-based production also minimizes delays caused by external factors such as adverse weather.

- Flexible offerings: PEBs offer design flexibility and quick installation, making them suitable for a wide range of applications, including industrial buildings and warehouses.

- Cost-effective: PEBs are cost-effective due to their reduced construction time and lower labour costs. Overall cost savings could be 20-40% on average.

- Sustainable: PEBs are environmentally friendly, as steel is recyclable and in-house manufacturing minimizes waste. They also require low maintenance, being resistant to pests, rot, and other structural issues.

Management's commentary on benefits of PEBs

Traditional RCC vs PEB

| Parameter | Traditional RCC Construction | Pre-engineered Steel Construction |

|---|---|---|

| Major Component | Concrete and reinforced steel bars | Steel and metal accessories |

| Raw Materials Used | Cement, steel, sand, bricks, etc. | Steel, sections, channels, coils etc. |

| Construction Location | Completely on site | Manufactured in controlled environments such as factories, only assembling or erection happens on site |

| Construction Time | Takes more construction time than PEB construction | 40%-50% lesser time than RCC as majority of components are manufactured in a controlled environment and only assembling of parts takes place on site |

| Manpower | Demands a substantial workforce since the entire construction process, including modifying and shaping concrete, occurs on-site | Approximately 25% lesser than the conventional method as only assembling of the final structure happens on site |

| Applications | Residential and low-rise commercial and infrastructural | Largely industrial applications or shed requirements at infrastructure setup |

| Effect Environment | More adverse environmental impact owing to the generation of significant waste and landfill mass during on-site construction activities | Owing to the streamlined nature of construction, it minimizes its environmental footprint by minimizing wastage, less air pollution |

| Modifications | Challenges in modifications once the concrete has hardened, making alterations complex & costly | Once flexible as modifications involve disjoining the assembly of prefabricated components, adjusting to make it more manageable & cost-effective |

| Cost Efficiency | Highly labour-intensive work in an uncontrolled environment, which makes it more costly than PEB structures | Comparatively lighter, requires less material, needs shorter construction time, and is cost-effective on-site, contributing to lower cost |

Phases of PEB Construction

The construction of a pre-engineered building is typically carried out in three primary phases - design, fabrication, and installation.

Design phase: This stage involves tasks such as site preparation, finalizing design specifications, and obtaining approvals. It is the most crucial step, as the quality of design directly influences the performance, cost-efficiency, and delivery timelines of the final structure.

Fabrication phase: Once the design is finalized, structural components are manufactured in a controlled factory environment. At this stage, substructures are also prepared, which not only enhance cost efficiency but also help accelerate overall project timelines. This parallel approach contributes to substantial savings in both time and resources.

Installation phase: In the final stage, pre-fabricated components are transported to the construction site and assembled with precision. Since most activities are completed off-site, on-site work is largely limited to bolting and erection, ensuring speed and consistency in quality.

Management's commentary on the Four Pillars of PEBs

Overview of global pre-engineered buildings industry

The global pre-engineered buildings market was valued at $19-21 billion in CY2023, compared with $15-17 billion in 2019. The market witnessed moderate growth during CY2019-2023 because of Covid-19 and its subsequent impact on the overall construction sector. The market is expected to clock a CAGR of 10.5-11.5% over the medium term and is projected to be valued at $32-34 billion by CY2028. This high growth could be attributed to the increasing awareness about modern off-site construction techniques, as well as rising demand for green buildings globally, which has resulted in a shift in focus to pre-engineered buildings. In 2023, the infrastructure segment accounted for the largest share of the global pre-engineered buildings market (40%), followed by buildings (36%) and industrial (23%).

Overview of pre-engineered buildings industry in India

In India, organized players account for about 40-45% of the total PEB market, with the remaining share held by small unorganized local players. The top seven organized players together contribute 80-85% of the organized sector's market. The organized sector benefits from a reliable track record, optimized supply chain capabilities and high quality engineering products. PEB industry is expected to grow at a 10-11% CAGR between FY24-29 to Rs 315-330 billion from 195b in FY24. Key growth drivers for PEB industry include rapid industrialization across india, increased infrastructure investments, urbanization and the need for modern large scale facilities. Additionally, PEBs are increasingly popular in sectors like e-commerce and cold storages, where the demand for efficient and scalable warehouses is very high.

Peers

| Company name | Date of incorporation | Installed capacity (MTPA) | Brief overview |

|---|---|---|---|

| Kirby Building Systems & Industries India Pvt Ltd | 2005 | 300,000 | Kirby is the market leader in the PEB industry in India, with its facilities at Haridwar and Hyderabad and Ahmedabad, Kirby is a part of the Alghanim Group, Kuwait, which has over 4 decades of experience in the global PEB industry. |

| Interarch Building Products | 1983 | 161,000 | Interarch Building Products has over 4 decades of experience in the PEB industry. Its facilities at Pantnagar and Kichha in Uttarakhand, Tamil Nadu and Andhra Pradesh, with further expansion plans in Gujarat. |

| Efeck Prefab Technologies Ltd* | 1999 | 133,924 | Efeck Prefab is a group company of Efeck and has over 2 decades of experience. It offers prefabricated and pre-engineered solutions across multiple sectors. It has facilities in Noida (UP), Haryana, Madhya Pradesh, and Andhra Pradesh. It also offers expanded polystyrene packaging (EPS) solutions (~20% of rev). |

| M & B Engineering Ltd | 1981 | 103,800 | M & B Engineering is one of India's leading providers of custom-specific turnkey solutions for engineering and infrastructure projects. It has facilities at Satana, Gujarat and Cheyar, Tamil Nadu. |

| Zamil Steel Buildings India Pvt Ltd | 2003 | 100,000 | Zamil Steel Buildings India is the subsidiary of Zamil Steel Pre-Engineered Buildings Co. Ltd, which is a part of the Zamil Group, Saudi Arabia. Zamil Steel Pre-Engineered Buildings is a key global structural steel/pre-engineered steel building supplier, having supplied to over 70,000 steel structures in 70 countries. |

| Pennar Industries Ltd | 1975 | 90,000 | Pennar Industries has over 5 decades of experience in offering a range of products and services, including pre-engineered buildings and structural steel buildings across various sectors. It has 13 manufacturing plants, with three related to PEBs located at Velkal (Telangana), Isnapur (Uttar Pradesh), and Sadashivpet (Telangana). Pennar Industries ~20% of its revenue from custom-steel structures. |

| Everest Industries Ltd | 1934 | 72,000 | Everest Industries is a pre-engineered steel building manufacturer in India and has over 9 decades of legacy with its facilities at Gujarat and Uttar Pradesh. |

| Smilh Structures (India) Pvt Ltd | 2011 | 72,000 | Smilh Structures (India) promoted by the Panchal family, has over a decade of experience in the industry, and provides customized and pre-engineered steel structures. |

Management's commentary on competition

Growth triggers and competitive advantage

Shift from RCC to PEB

Growing awareness of PEB structures along with their benefits over traditional RCC construction has led to an increase in PEB projects. PEBs not only help in expediting the project timelines but also is more sustainable due to less wastage. As a result, pre-engineered construction structures are garnering greater acceptance over traditional onsite construction practices of erecting entire structures onsite. This positioning is expected to serve as a catalyst for growth of pre-engineered structures in the construction industry.

Relationship with clients acts as a moat

Interarch has successfully executed over 750 PEB projects to date and has built a strong, trusted brand, as evidenced by over 60% of its clients have maintained relationships for more than five years. Over the past three years, the company has consistently achieved a repeat order ratio exceeding 80%, serving prestigious clients such as Aditya Birla Group, HUL, and the Tata Group. Recently, Interarch achieved a significant milestone by securing India's largest PEB contract, valued at ₹300+ crore, where it is serving as the sole contractor for the first time - marking a major achievement in the company's history.

Management's commentary on USP and competitive advantage

Interarch is gaining market share in organised sector

Capex and manufacturing facilities

As of Q1 FY26, Interarch operates five manufacturing facilities across Uttarakhand (Pantnagar, Kichha), Tamil Nadu (two units at Sriperumbudur) and Andhra Pradesh (Athivaram - phase 1 commissioned in FY25), with an installed capacity of 1,61,000 MTPA and typical utilizable capacity of 80–85% (1,35,000 MTPA). Phase 2 of the Athivaram plant and a new line at Kichha (Uttarakhand) are on track for commissioning in Q2 FY26, adding 40,000 MTPA and taking installed capacity to 2,00,000 MTPA with a revenue potential of 2000-2200cr at full utilization.

Additionally, the company has acquired 20 acres adjoining the Andhra Pradesh plant to establish a dedicated heavy steel structures facility, targeted for commercialization by July 2026. Interarch has also acquired land in Kheda, Gujarat, for a planned integrated PEB facility.

Strong team of engineers & fast execution

Interarch boasts a strong in-house design capability, with a team of 119 qualified structural design engineers and detailers operating out of three dedicated design centres located in Noida, Chennai, and Hyderabad. This in-house expertise forms one of the company's key competitive moats, enabling efficient, precise, and optimised structural and architectural design solutions for its projects. In the PEB industry, clients place high value on suppliers with established design and architectural capabilities, as these directly impact both the functionality and aesthetics of the final structure.

Heavy steel structures

Interarch is setting up a greenfield heavy steel structure facility in Andhra Pradesh with an initial capacity of 24,000 MTPA, targeted for completion by Q2 FY27. Heavy steel structures typically weigh 5-15 tonnes per piece, compared to 2-3 tonnes for light steel components. Currently, Interarch sources around 1,000–1,200 tonnes of heavy steel per month through a supply arrangement with Jindal Steel. To become self-reliant in heavy steel supply, the company is investing in its own dedicated facility, which will enable Interarch to bid for larger, high-value projects and tap into emerging opportunities in high-rise building and data center construction.

Growth in average order size

Interarch's average order size has increased significantly, rising from ₹3.5–4 crore three years ago to ₹10–11 crore currently. Larger ticket projects typically deliver better margins, and currently over half of new order inflows are now above ₹20 crore.

Partnership with Mold-Tek & Export Opportunities

Interarch has entered into a strategic tie-up with mold-tek Technologies, under which Interarch manages manufacturing and logistics, while mold-tek provides detailing support and sources export orders. The arrangement is exclusive for mold-tek originated projects and is structured on a commission basis.

Key Risks

- Steel price volatility: The company enters into fixed price contracts and holds inventory of ~2 months of raw material (steel). Sharp volatility in prices of raw material can affect the financials of the company.

- Slowdown in Capex Cycle: Interarch's order inflow is dependent on the private capex cycle. If there is a slowdown in the capex cycle it will result in a slowdown for the company.

- Dependence on talent: Company relies on its internal design & engineering team for optimum & efficient designing of its project. Any alteration or loss of this talent may cause the company to lose market share and revenues.

- Competitive intensity and pricing pressure: Rising competition could lead to pricing wars, compressing margins for interarch. The PEB industry has low entry barriers, making increased rivalry a key risk for Interarch.

Valuations

| FY25 | FY26E | FY27E | |

|---|---|---|---|

| sales | 1,454 | 1,723 | 2,085 |

| % growth | 18.50% | 21% | |

| EBITDA margin | 9.35% | 9.50% | 10.00% |

| EBITDA | 136 | 163.68 | 208.48 |

| other income | 21 | 24.12 | 25.00 |

| dep | 12 | 15.5 | 19.6 |

| interest | 2 | 2 | 2 |

| PBT | 143 | 170.31 | 211.88 |

| tax | 24% | 25% | 25% |

| PAT | 108.68 | 127.73 | 158.91 |

| % growth | 17.53% | 24.41% |

This post has been provided solely for information purposes and does not constitute an offer or solicitation of an offer or any advice or recommendation to purchase any securities or other financial instruments and may not be construed as such. The author makes no representations as to the accuracy or completeness of any information in this post , Do your own diligence and consider this blog as just an educational piece.